Super G Provides Growth Capital to SaaS Company

The Company:

Sponsor-backed, cloud-based software platform primarily marketed to outbound sales organizations.

The Financing Situation:

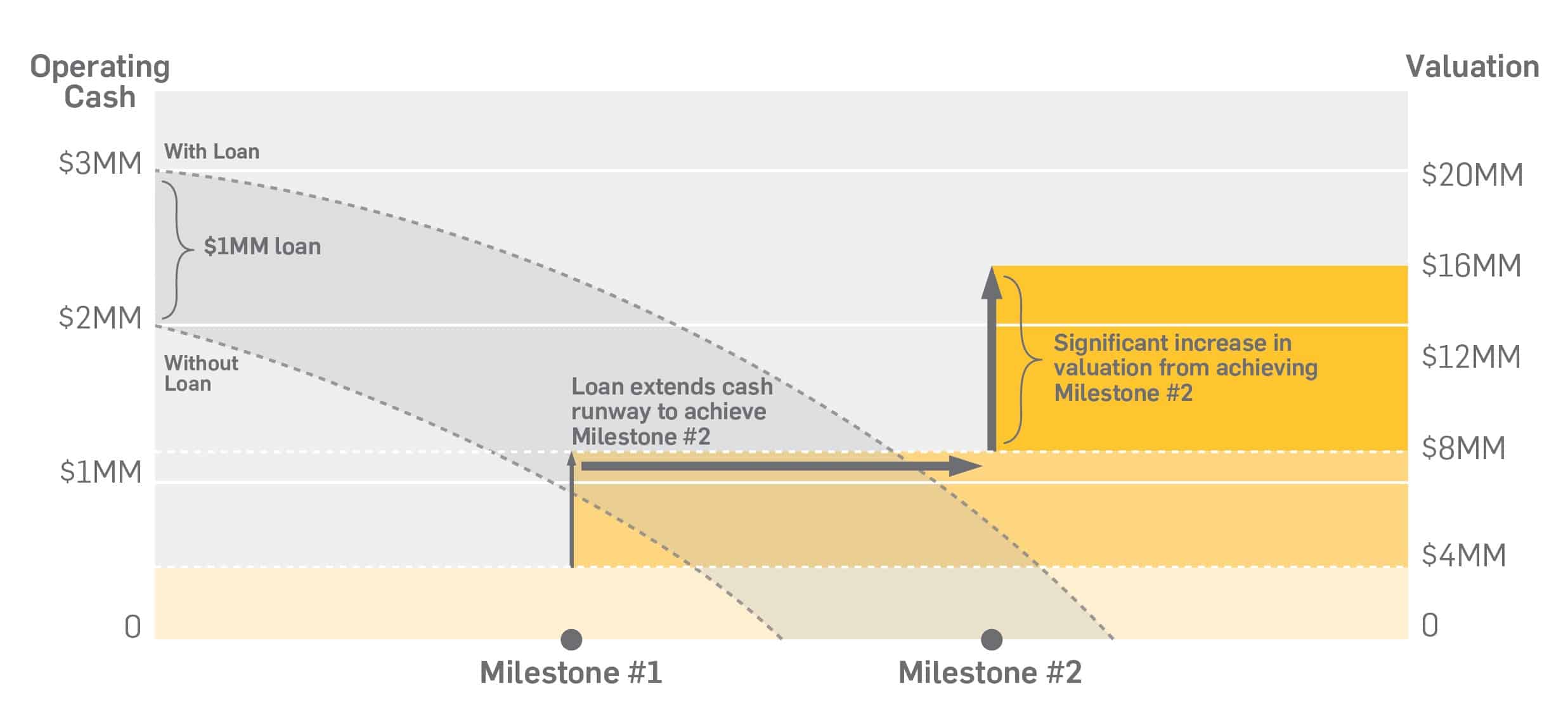

The Company raised over $3MM in a Series A equity round and experienced significant growth over the prior three years. The Company needed growth capital to execute on its sales pipeline, but did not want to raise additional equity before its Series B round due to dilution concerns at the current valuation. The Company wanted to grow revenue as much as possible in order to increase its valuation prior to raising additional equity.

The Solution:

Super G provided a non-dilutive senior secured term loan. This structure enabled the Company to continue its growth trajectory and increase its valuation before raising additional equity. Super G was able to quickly get comfortable given the rapid growth, contracted recurring revenue and strong management team. The amount of time from signed term sheet to closing was less than two weeks.

Super G’s non-dilutive growth capital loans help technology companies extend runway and reach milestones which increase valuation while protecting equity.